irvine income tax rate

University of California Irvine. Detailed California state income tax rates and brackets are available on this page.

Why Households Need 300 000 To Live A Middle Class Lifestyle

Orange County Sales Tax.

. Use our free directory to instantly connect with verified State Income Tax attorneys. - Tax Rates can have a big impact when Comparing Cost of Living. The Income Tax Rate for Irvine is 93.

Income and Salaries for Irvine zip 92618 -. What is the sales tax rate in Irvine California. California State Sales Tax.

Orange County Property Tax. 4330 Barranca Pkwy Ste 150a. The minimum combined 2022 sales tax rate for Irvine California is.

So the more taxable income you earn the higher the tax youll be paying. Irvine income tax rate Saturday February 26 2022 Edit. The average cumulative sales tax rate in Irvine California is 775.

The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022. The US average is 46. - The Income Tax Rate for Irvine is 93.

Whether you come in to your local Irvine HR Block office to work. Taxable income band MYR. Tax Rates for Irvine The Sales Tax Rate for Irvine is 78.

Irvine Unified School District. Free Tax Filing Wednesdays February 2 April 6 The City of Irvine in partnership with Orange County United Way OCUW is offering free tax preparation services to taxpayers who earned. Irvine is located within Orange County California.

We have info about recent selling dates and prices property transfers and the top-rated. Irvine City Sales Tax. This is the total of state county and city sales tax rates.

The US average is 46. The US average is 46. This includes the rates on the state county city and special levels.

Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan Realtymonks One Stop Real Estate. University Park Irvine City Sales Tax. Tax Rates for Irvine - The Sales Tax Rate for Irvine is 78.

Compare the best State Income Tax lawyers near Irvine CA today. Irvine income tax rate Wednesday February 16 2022 Edit. View all 42 Locations.

- The Income Tax Rate for Irvine zip 92618 is 93. Income Tax Rates and Thresholds Annual Tax Rate. The US average is 73.

As a way to measure the quality of schools we analyzed the math and readinglanguage. - Tax Rates can have a big impact when. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075.

0 to 5000 Tax rate. At 158 percent it would be. The US average is 73.

California State Sales Tax. Orange County Sales Tax.

2020 Tax Brackets Deductions Plus More Hbla

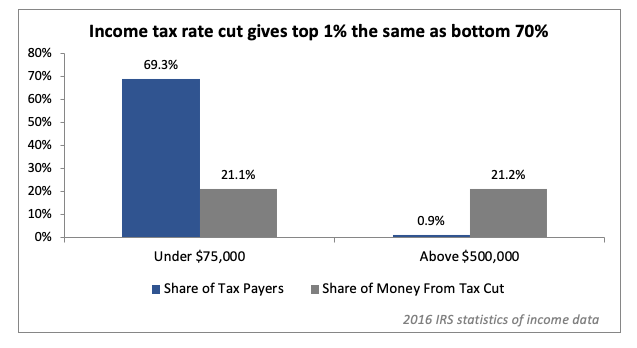

12 Ways To Beat Capital Gains Tax In The Age Of Trump

California Sales Tax Rate Rates Calculator Avalara

Irvine Real Estate Market Prices Trends Forecast 2022 2023

Complying With New Schedules K 2 And K 3

Kwasi Kwarteng Axes Top Income Tax Rate For Highest Earners Irvine Times

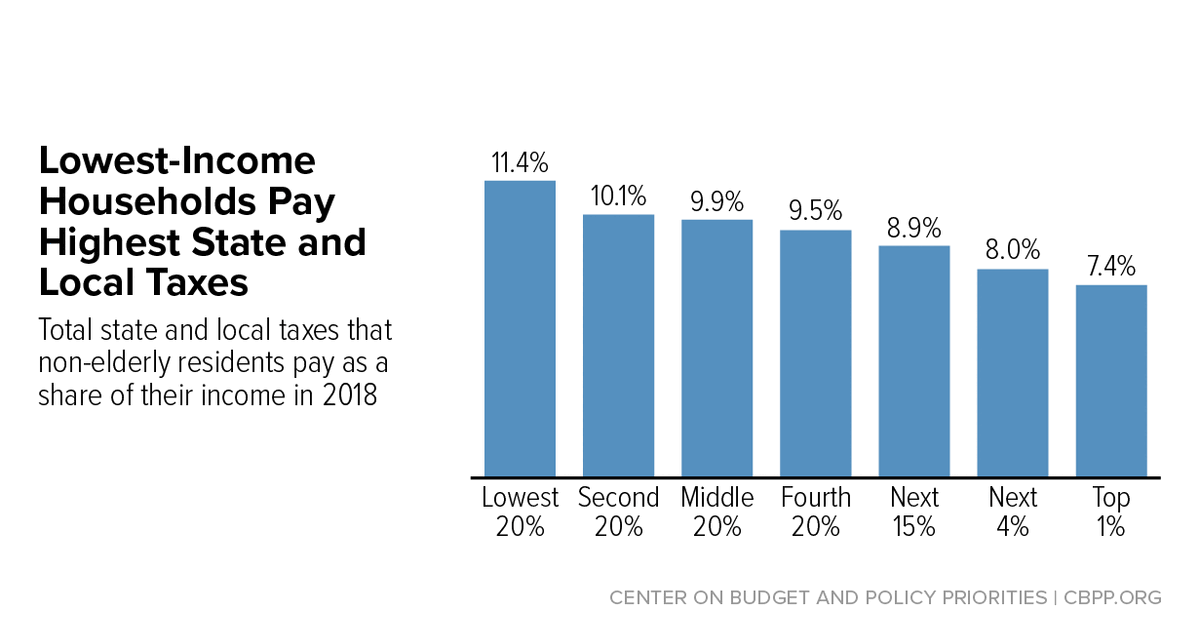

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Mello Roos Taxes And What That Means For Irvine Home Owners Ellie Yung Orange County Realtor Irvine California Great Park Orchard Hills Portola Springs I Northpark

Expert Advice For Moving To Irvine Ca 2022 Relocation Guide

Federal Income Taxation In Focus Second Edition Dexter 9781543857016 Aspen Publishing

Overview Of The Individual Provisions In The New Tax Reform Act Draffin Tucker

How Tax Diversification Can Improve Your Odds Of Success

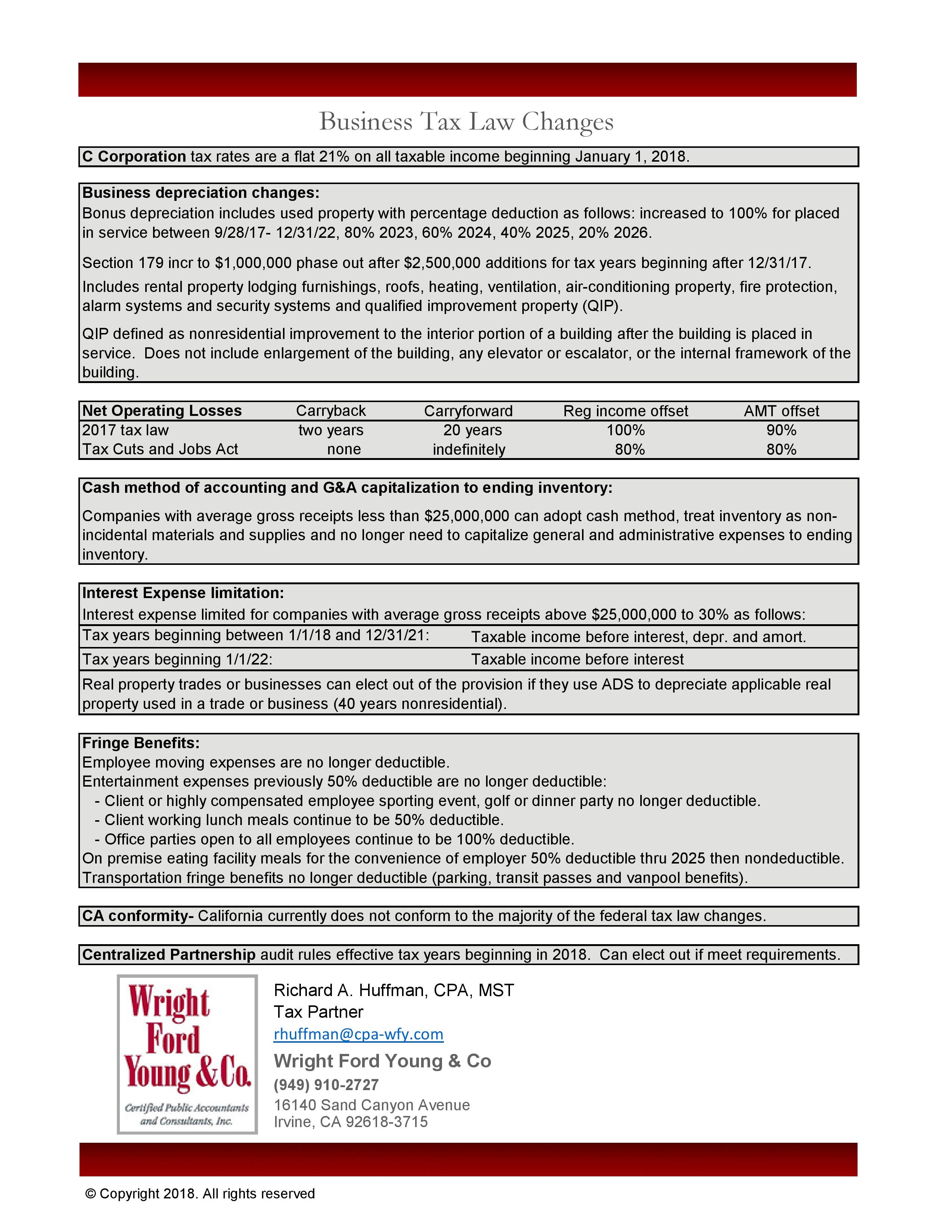

Tax Law Changes Business Chart And Highlights Wright Ford Young Co

Masler Associates Cpas Taxes Accounting Irvine Orange County

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California Sales Tax Rates By City County 2022

How Much Tax Do You Pay When You Sell Your House In California Property Escape