defer capital gains taxes indefinitely

This allows you to pay just one tax at the long-term capital gains rate. Since long-term capital gains taxes typically run 15 to 20 this can add up to a sizable sum that can be invested elsewhere.

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital gains taxes can be delayed indefinitely.

. While investing in real estate through the buying and selling of property can be a lucrative endeavor in order for an investor. Contact a Fidelity Advisor. Wait at least one year before selling a property.

You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be. There are specific rules and. Doing so can allow an investors money to grow tax free over time.

Ad If youre one of the millions of Americans who invested in stocks. Ad Become a Tax-Aide volunteer. If the gain is.

6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. Protecting against a taxable event in case a 1031 cant be completed within the 6 months or. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

Leverage the IRS Primary Residence. A capital gains tax bill may come as a surprise to some real estate investors but one of the major benefits of commercial real estate is that there are strategies that can be used to defer it. There is a way to accomplish the.

453However when reading Sec. While investing in real estate through the buying and selling of property can be a lucrative endeavor in order for an. With a 1031 exchange you can defer capital gains taxes indefinitely if you keep reinvesting in other like kind or similar rental properties.

By performing a 1031 exchange investors defer capital gains tax indefinitely as long as they continue to reinvest the principal in the property. You dont have to be a tax pro. Defer Capital Gain and Depreciation Recapture Taxes Indefinitely.

With a 1031 exchange though you can defer taxes indefinitely. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Depending on your income it will either be.

Their capital gain taxes and depreciation recapture taxes can be deferred indefinitely by continually structuring and using 1031 Tax Deferred Exchange strategies. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. Defer capital gains by investing 100 of the sales proceeds from within the DST or.

Deferred Sales Trusts unlike exchange-based tax-deferment methods are an example of a special type of sale known as an installment sale which can be used to defer. Whatever your skillset theres a role for you. For this reason investors are well served to consider one of the followin See more.

How to Defer Tax on Capital Gains Tax-Deferred Exchange. The capital gains will eventually be taxed when that property is sold or will be deferred again. Provide free tax prep assistance to those who need it most.

Moreover investors can keep 1031 exchanges. There is also 30 Income Tax relief on the investment.

Your Guide To Capital Gains Taxes Farm Bureau Financial Services

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

How To Avoid Capital Gains Tax In Real Estate Mybanktracker

A Helpful Overview Of Capital Gains Taxes Laws Com

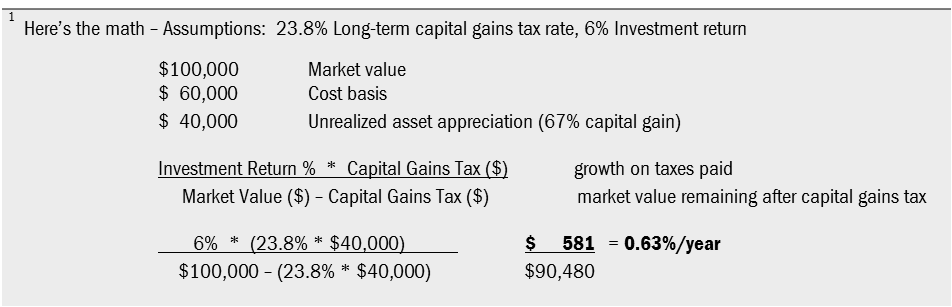

High Class Problem Large Realized Capital Gains Montag Wealth

High Class Problem Large Realized Capital Gains Montag Wealth

How To Defer Capital Gains Tax 7 Methods For Investors Fnrp

High Class Problem Large Realized Capital Gains Montag Wealth

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Defer Capital Gains Using Like Kind Exchanges Caras Shulman

1031 Exchange Timeline How The Irs 1031 Exchange Process Works

Rethinking How We Score Capital Gains Tax Reform Tax Policy And The Economy Vol 36

How To Avoid Capital Gains Tax Personal Capital

Deferred Sales Trust Defer Capital Gains Tax

Doing Business In The United States Federal Tax Issues Pwc

Exit 01 How To Reduce Capital Gains Taxes On Real Estate With Passive Losses Tax Loss Harvesting

Learn How To Defer Capital Gains Tax For 30 Years Aaoa

The Difference Between Income Tax Capital Gains Tax Westwood Net Lease Advisors Llc

Money Clip Protection Minimizing Your Exposure To Capital Gains Taxes