free crypto tax calculator uk

The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

Bitmarket Is Clean And Modern Design Responsive Html Template For Bitcoin Crypto Currency Exchange And Trading Company W Templates Cryptocurrency Bitcoin

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

. Since then its developers have been creating native apps for mobile devices and other upgrades. We offer a free trial so you can try our service and get comfortable with how it works. Mining staking income.

If youre looking for a way to track your. That means you calculate your capital gains and if the result is below the limit you dont need to. Use our Crypto Tax Calculator.

Tax doesnt have to be taxing. Crypto tax breaks. Covers NFTs DeFi DEX trading.

See our 500 reviews on. Blox free Pro plan costs 50K AUM and covers 100 transactions. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

Ethereum Solana and more. There are cloud-hosting tools specifically designed for crypto miners. You simply import all your transaction history and export your report.

0325 5000 1625. Calculating cryptocurrency in the UK is fairly difficult due to the unique. Check out our free guide on crypto taxes in UK.

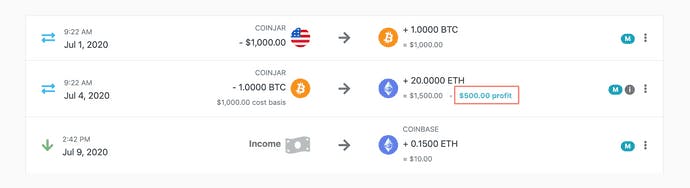

Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically provides the gains or loss and other relevant information to populate your tax reports. The original software debuted in 2014. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard. Be sure to add how long youve owned the cryptocurrency. 12570 Personal Income Tax Allowance.

File your crypto taxes in the UK. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Blox supports the majority of the crypto coins and guides you through your taxation process.

DeFi DEX trading. If you are looking for the middle of the road then Zenledger is exactly what you are looking for. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

Income report - Mining staking etc. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. The platform is also to start using Koinlys crypto tax calculator.

Your first 12570 of income in the UK is tax free for the 20212022 tax year. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. Supports HMRC Tax Guidelines.

Check out our free and comprehensive guide to crypto taxes in the UK. Janes estimated capital gains tax on her crypto asset sale is 1625. The free trial is available for 30 days.

Capital gains tax report. To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. We have listed down 4 of the.

Available in 20 countries. How to calculate your UK crypto tax. Work out your total taxable gains from crypto investments.

You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. You can discuss tax scenarios with your accountant. Get Started For Free.

In any case they still offer very detailed reports on all the limited things they offer. Best Crypto Tax calculator in the UK. UK citizens have to report their capital gains from cryptocurrencies.

Heres an example of how to calculate the cost basis of your cryptocurrency. It makes calculating your capital gains easy by using Share Pooling and follows HMRCs guidelines. 3 Cointelli Cointelli is the next-generation cloud-based crypto tax preparation software developed by Mark Kang the CEOco-founder and a CPA.

Take the initial investment amount lets assume it is 1000. 49 for all financial years. CoinTrackinginfo - the most popular crypto tax calculator.

Find the highest rated crypto tax software in the uk pricing reviews free demos trials and more. Sort out your crypto tax nightmare. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines.

You can start using Koinly for free and only pay when youre ready to generate reports. The resulting number is your cost basis 10000 1000 10. Enter the price for which you purchased your crypto and the price at which you sold your crypto.

How to calculate your UK crypto tax. Trades and sales of crypto assets to which Capital Gains Tax applies are reported on the Capital Gains Tax Summary SA108 fields 14 22 while income from staking or any other crypto activity is reported on your main Tax Return under Other UK Income field 17. Integrates major exchanges wallets and chains.

It can calculate tax incidence on crypto buying and selling transactions DeFi margin trading etc. The free version doesnt have too much to offer like Koinly it has only 25 transactions and no DeFi projects. The tax rate on this particular bracket is 325.

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day. UK crypto investors can pay less tax on crypto by making the most of tax breaks. Supports DeFi NFTs and decentralized exchanges.

Start for free pay only when you are ready to generate your. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

Koinly helps UK citizens calculate their crypto capital gains. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. The ultimate uk crypto tax guide 2020.

Integrates major exchanges wallets chains. The software is available in over 20 countries including the UK. Use our Crypto Tax Calculator.

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. The uk requires a specific type of method for calculating the cost basis of your coins known as shared pool accounting. Koinly is the most popular software to calculate crypto taxes.

How to use a crypto tax calculator to calculate your crypto taxes. It has been implemented with a new algorithm that enables the system to support accurate NFT tax calculations.

Best Crypto Tax Software Top Solutions For 2022

Bitcoin Crypto Tax Reporting Blockpit Cryptotax

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Learn To Trade Bitcoin For Free Bitcoin Price Bitcoin Bitcoin Mining

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

5 Best Crypto Tax Software Accounting Calculators 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Bitcoin Crypto Tax Reporting Blockpit Cryptotax

Best Crypto Tax Software Top Solutions For 2022

Everything You Need To Know About Study Loan In Singapore Study Loan Personal Loans

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Germany Crypto Tax Guide 2022 Koinly

Capital Gains Tax Calculator Ey Global

Ripple Xrp 200 Companies In Ripplenet 7th In The Ranking And New Office In Dubai Ripple Bitcoin Cryptocurrency

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare